Via Wei Yao of Societe Generale, Imagine a hard landing in China...

Via Wei Yao of Societe Generale, Imagine a hard landing in China...The Chinese economy has been enjoying a cyclical rebound since the beginning of Q4 2012. SocGen's central scenario is that this recovery will last until early Q2 2013 and then gradually lose momentum. In the medium term, they still anticipate a bumpy path of secular deceleration, leading to an average growth rate of 6-7% over the next five to seven years, down from 10% per annum over the last three decades.

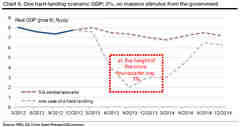

This piece focuses on what is probably the most popular “what-if” question about the Chinese economy – what if China hard lands? We define a hard landing in 2013 as one where the official, full-year, real GDP growth rate plummets to below 6%, which we see as the minimum level needed to keep the job market stable and avoid systemic financial risk. As China undergoes demographic ageing and growth of the working-age population slows, this minimum stable growth level will decline further. However, if progress in rebalancing and structural reform remains slow, the probability of a hard landing will rise over the medium term. In the tail risk scenario set out below, 2013 will see several quarters with just 3% growth and full year growth would stand at just 4.2% compared to our central scenario of 7.4%.

*What are the most likely triggers?*

Two types of events could trigger a hard landing in China. First, the experience of 2008 showed that the Chinese economy is vulnerable to trade shocks. The Lehman crisis made exports go into reverse, resulting in the loss of nearly 50 million migrant worker jobs in the two quarters after it took place. Second, a hard landing could be provoked by either insufficient public investment from Beijing or a sharp property market correction, which could also be partly induced by tight policies. Policymakers might choose to do so out of concerns over systemic risks posed by local governments’ unhealthy leverage or rising social discontent on high housing prices. The point is that they would not deliberately choose to force a fast correction, but as China’s imbalances are already at a precarious level, the room for error and the likelihood of nasty unintended consequences is not negligible.

However, China is unlikely to experience a currency crisis like the Asian Financial Crisis, as it has little external debt and a still largely controlled capital account. The domestic financial market also lacks the clout to trigger a sharp correction, even though the dynamics there could aggravate the situation once the downward trend is set in motion.

*How would the crisis evolve?*

Whatever the catalyst, the *excess capacity in the manufacturing sector – estimated at 40% in 2011 by the IMF – would be exacerbated by a sharp growth slowdown.* This would cut corporate margins sharply, making profits plunge, and triggering a downward spiral in domestic demand. Bankruptcies and unemployment would occur on a large scale, endangering financial and social stability. *One factor that could accelerate the downward spiral is the high leverage of China’s corporate sector,* which exceeded 120% of GDP at end-2011 and has kept rising throughout 2012. As the crisis progressed, non-performing loans would undoubtedly rise beyond the capacity of local governments to contain them, as their fiscal resources dwindled. Even in China’s (semi-) controlled system, banks could choose to freeze lending as a knee-jerk reaction, while the authorities rushed to draft a decisive response. The rapid development of the non-bank credit market in the last few years, especially shadow banking activities, has created a new vector through which a systemic liquidity crunch could take place. Capital outflow would likely ensue, stretching domestic liquidity conditions further.

*How would the government respond?*

China’s political institutions allow the government to respond promptly in a crisis. *A hard landing would test the new leaders’ willingness and capability to transform China from a capex-driven economy to one fuelled by consumption demand.* The easy but dangerous choice would be for Beijing to repeat the post-Lehman package of massive state-driven lending and investment facilitated by ultra-low interest rates and ample liquidity. However, such a solution would be less effective than in 2009 given the overhang in capacity, and would increase corporate leverage even further. *A more judicious response would combine genuine tax cuts to lower the burden on the corporate sector, further liberalisation to give private enterprises new space to grow, more social spending to anchor consumption, and selective state investment to prepare China better for future challenges.* We believe such policies could pave the way to more sustainable growth in the medium term. In the short term, however, the impact on growth would be gradual, likely putting the new leaders under immense political and social pressure. There would be many aspects of policy response and an unlimited number of combinations. We would like to elaborate more on two aspects that would have direct and clear implications for the financial market.

· *Monetary policy. *To be more specific, there would be monetary policy easing, but relying more on the market mechanism. The People’s Bank of China would both cut the Reserve Requirement Ratio (RRR) (likely by 400-500bps) and conduct sizeable repo operations to counter any capital outflow pressure and to ease liquidity conditions, so that money market rates could go down to the level seen in 2008. The benchmark deposit rate would be cut aggressively from 3% to 2%, while the benchmark lending rate might simply be scrapped, serving the dual purposes of liberalisation and policy easing. However, state-driven lending would not be pushed, at least not as much as in 2009. Hence, credit demand would mend, albeit much more gradually.

· *Currency policy and capital controls. *With regards to the currency, there would be immense depreciation pressure from the market. The PBoC would allow the market to push USD/CNY up, instead of arbitrarily fixing the yuan like the response to the Lehman Crisis. The spot rate could easily shoot up to 7, i.e. 10% nominal depreciation. However, the PBoC would also beware of the danger of unchecked capital flight and would likely intervene to stabilise the currency market at a certain point. In any case, FX reserves would probably stop rising or even decline at the height of the crisis. Throughout the process, we would not expect the PBoC to use capital controls as extensively as before.

*How bad could things get?*

To put it bluntly, the situation could get as bad as one dares to imagine, since the history of economic crises is packed with nasty surprises. In terms of GDP components, fixed asset investment usually contracts outright in a crisis, while consumption growth merely decelerates. If the government chooses the second (more difficult) path discussed above, investment growth might grind to a halt in the year after the crisis first hit, which implies at least one quarterly contraction. Household consumption would probably hold up better thanks to the accommodative and targeted fiscal policies. Together with direct fiscal spending, total consumption could grow by 4-5% annually. Assuming that there is no other shock to external demand, imports would probably fall more sharply than exports, so net exports would contribute positively to growth. *Putting this together suggests GDP growth of only 3% during the four quarters between Q2 2013 and Q1 2014.*

*What would happen afterwards?*

The difference between our central scenario and this risk scenario is merely the pace at which China corrects its structural problem of a production economy out of proportion to the consumption economy. Under our central scenario, investment will decelerate gradually and consumption increase moderately faster to partially offset the drag. This will only be possible if the new leaders proceed steadily with necessary reforms to improve investment efficiency, liberalise vital sectors and grow consumption sustainably. On the other hand, an abrupt correction doesn’t have to mark the end of China’s growth story, like Japan in the 1990s. *It is the top leaders’ choices during the difficult times ahead that will determine the fate of the Chinese economy.* The key is not to waste a crisis. Reported by Zero Hedge 2 days ago.