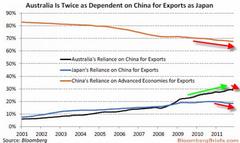

A month ago we pointed out that as a result of Australia's unprecedented reliance on China as a target export market, accounting for nearly 30% of all Australian exports (with the flipside being just as true, as Australia now is the fifth-biggest source of Chinese imports), the two countries may as well be joined at the hip.

A month ago we pointed out that as a result of Australia's unprecedented reliance on China as a target export market, accounting for nearly 30% of all Australian exports (with the flipside being just as true, as Australia now is the fifth-biggest source of Chinese imports), the two countries may as well be joined at the hip.Over the weekend, Australia appears to have come to the same conclusion, with the Australian reporting that the land down under is set to say goodbye to the world's "reserve currency" in its trade dealings with the world's biggest marginal economic power, China, *and will enable the direct convertibility of the Australian dollar into Chinese yuan, without US Dollar intermediation*, in the process "slashing costs for thousands of business" and also confirming speculation that China is fully intent on, little by little, chipping away at the dollar's reserve currency status until one day it no longer is.

That said, this latest development in global currency relations should come as no surprise to those who have followed our series on China's slow but certain internationalization of its currency over the past two years. To wit: "World's Second (China) And Third Largest (Japan) Economies To Bypass Dollar, Engage In Direct Currency Trade", "China, Russia Drop Dollar In Bilateral Trade", "China And Iran To Bypass Dollar, Plan Oil Barter System", "India and Japan sign new $15bn currency swap agreement", "Iran, Russia Replace Dollar With Rial, Ruble in Trade, Fars Says", "India Joins Asian Dollar Exclusion Zone, Will Transact With Iran In Rupees", and "The USD Trap Is Closing: Dollar Exclusion Zone Crosses The Pacific As Brazil Signs China Currency Swap."

And while previously the focus was on Chinese currency swap arrangements, the uniqueness of this weekend's news is that it promotes outright convertibility of the Yuan: something China has long said would happen but many were skeptical it ever would. That is no longer the case, and with Australia setting the precedent, expect many more Asian countries (at first) to follow in Australia's footsteps, because while the developed world is far more engaged in diluting its currency as a means to spur "growth", Asian and developing world nations are still engage in real, actual trade, where China is rapidly and aggressively becoming the world's hub.

More from The Australian:

Former ambassador to China Geoff Raby, now a Beijing-based business figure, told The Weekend Australian: "*The value of such a deal would be substantial for exporters to China, especially those that import a lot from China like mining companies, as it would remove business constraints including exchange-rate risks and transaction costs.*"

Businesses, like individuals when travelling, have to pay extra to convert currency since there are different rates for buying and selling.

So removing one step also cuts out the cost of paying for such a "spread".

Australia has undertaken significant lobbying for the deal and the direct conversion of the yuan, also referred to as the renminbi (RMB), is identified as a priority in the government's Asian century white paper.

"We have held preliminary discussions with the Chinese government to explore how soon direct convertibility can be practicably achieved," the white paper says.

"We are continuing these discussions, and also exploring other opportunities to work with China to support the internationalisation of the RMB."

Australia's banks increasingly arrange trade finance through Hong Kong, which has developed a special role as China's chief international finance centre.

Needless to say, China is eagerly looking forward to taking yet another bite out of the USD's reserve status.

New President Xi Jinping, a former Communist Party secretary of Shanghai, is a champion of that city's development as China's finance hub, and it is believed that the Prime Minister may fly there to sign the currency conversion deal.

Ms Gillard is expected to go on from Shanghai to Beijing, where she will open the third Australia China Economic and Trade Forum organised primarily by the Australia China Business Council, which will be bringing about 100 people from Australia for the event. Participants are likely to include Andrew Harding, Rio Tinto's new chief executive for iron ore; Warwick Smith, ANZ Bank's chairman for NSW and the ACT; Australian Trade Minister Craig Emerson and Financial Services Minister Bill Shorten; Gao Hucheng, China's Commerce Minister; and Gao Xiqing, the acting head of China Investment Corporation, the country's vast sovereign wealth fund.

The ANZ Bank has been a strong advocate of direct convertibility between the dollar and the yuan. Gilles Plante, the bank's chief executive in Asia, said in a recent report that in the last financial year, China accounted for 29 per cent of all exports and 18 per cent of imports, but the value of that trade denominated in yuan was less than 0.3 per cent.

He forecast that cross-border flows of funds would be liberalised "to support Shanghai's plan to build itself as a global financial centre. At the time the whole world is digging out opportunities from the rise of the yuan, Australia should not lag behind."

It was significant the liberalising governor of the People's Bank, Zhou Xiaochuan, kept his job during the reshuffle of China's leadership. He said last year at a conference: "The next movement related to the yuan is going to be reform of convertibility. We are moving in this direction; we need to go further, we will have some deregulation."

Most importantly, to China, Australia will serve as the Guniea Pig - should this experiment in FX liberalization work out to China's satisfaction, expect Beijing to engage many more trade partners in direct currency conversion.

Beijing appears to have chosen Canberra as its partner in this next movement for straightforward economic reasons, as Australia has become China's fifth-biggest source of imports and thus, the appropriate partner for the march of its currency.

Ms Gillard and President Xi Jinping may also during the visit establish a "strategic partnership" between the countries. This will enable Australia to catch up in status with a large range of nations.

Why is this so very critical? For the simple reason that the free lunch the US has enjoyed ever since the advent of the US dollar as world reserve currency, may be coming to an end as other, more aggressive alternatives - both fiat, and hard-asset based - to the USD appear. And since there is no such thing as a free lunch, all the deferred pain the US Treasury Department has been able to offset thanks to its global currency monopoly status will come crashing down the second the world starts getting doubts about the true nature of just who the real reserve currency will be in the future. Reported by Zero Hedge 1 day ago.