Now that China's economic slowdown is official, and in the aftermath of the Q1 trade data embarrassment Chinese GDP may have no choice but to print at a sub-7% annualized rate (especially if the PBOC continues to stubbornly refuse to inject liquidity in the financial system), it is no surprise that Emerging Markets around the world have seen a furious smack down in the past several weeks, with many markets now outright negative for 2013. At the same time corporations, trading in still buoyant markets, which have extensive exposure to China on both a top- and bottom-line basis, have managed to avoid the beatdown due to their presence in liquidity-friendly regimes. But how much longer will central bank beta float all boats burdened by increasingly heavy (lack of) alpha? And which companies are the most exposed to China's, and broadly Asia's, consumption slow down? Below, we present the answer for companies that have both a discretionary and staples exposure to the China and the Asia (ex-Japan) markets.

Now that China's economic slowdown is official, and in the aftermath of the Q1 trade data embarrassment Chinese GDP may have no choice but to print at a sub-7% annualized rate (especially if the PBOC continues to stubbornly refuse to inject liquidity in the financial system), it is no surprise that Emerging Markets around the world have seen a furious smack down in the past several weeks, with many markets now outright negative for 2013. At the same time corporations, trading in still buoyant markets, which have extensive exposure to China on both a top- and bottom-line basis, have managed to avoid the beatdown due to their presence in liquidity-friendly regimes. But how much longer will central bank beta float all boats burdened by increasingly heavy (lack of) alpha? And which companies are the most exposed to China's, and broadly Asia's, consumption slow down? Below, we present the answer for companies that have both a discretionary and staples exposure to the China and the Asia (ex-Japan) markets.Discretionary:

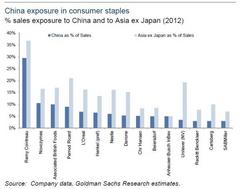

Staples:

Some highlights from the universe above:

Richemont offers China exposure in watches (IWC, Vacheron Constantin, Jaeger LeCoultre), jewellery (Cartier, Van Cleef & Arpels) and online luxury distribution (Net a Porter). In the past, Richemont has utilised its growth and cost advantage to support margin and return on capital expansion by over 500 bp since 2004, delivering sector leading cash returns (25% vs. 20% for luxury sector). Can it continue to do so?

LVMH has also benefited in the past from its exposure to the luxury and aspirational Chinese segments. On a divisional basis, fashion and leather goods, with a unique asset in category leader Louis Vuitton brand. Selective Retail (DFS and Sephora) now accounts for 28% of group sales and is levered to the rising middle class growth in China.

Remy Cointreau & Pernod Ricard is the foreign spirits leader in China. With c. 40% of group revenue in China, Remy has been the most obvious beneficiary of the positive dynamics for imported spirits in China. Furthermore, Remy’s exposure to China is principally through cognac, a category for which China is driving global value growth with 45% of total cognac sales by value in China. But with the benefit of the upside already priced in, how will the brand withstand a China where a secular shift to slower trend growth appears to be the new norm? Reported by Zero Hedge 1 hour ago.