In This Issue.

* Aussie inflation weakens.

* RBNZ leaves rates unchanged.

* Norway has huge bond maturity coming.

* TTWS X 2 Today!

And, Now, Today's Pfennig For Your Thoughts!

Australia To Allocate Reserves To China.

Good day. And a Wonderful Wednesday! It occurred to me yesterday that we had gone past Earth Day. I bet you were glad that I didn't just recycle an old Pfennig for you! HA! It was a weird day yesterday, as I went home with a stomach problem, and then slept most of the day. You know, the Big Boss Frank Trotter, asked the other day how I was feeling. And I think what I told him holds true most of the time. I feel about as good as someone can that takes chemo twice every day. And so it is.

So. Yesterday, I told you that it was a Risk Off Day. but that didn't last too long, for when I awoke from my daytime slumber, I saw that the U.S. stocks bucked the pattern, and rallied. So, that made me happy only because that meant the stupid Risk Off / On trading pattern had been broken, like I thought it had been before! Stocks, bonds, currencies and commodities all have different pricing mechanisms, and should be traded that way!

OK. the currencies and commodities spent yesterday in a funk, dealing with the poor showings of manufacturing reports from Germany and China. But that was yesterday, and today, the markets have forgotten about those poor showings, or so it seems. The euro is back above 1.30, and the Chinese renminbi / yuan is now trading at the top of its band. So, either the band has to be widened, or the renminbi / yuan is stuck in the mud. Or, I guess it could drop back... But I just don't see that happening. It was last week that the People's Bank of China guy, said that the band would have to be widened soon. I guess he wasn't kidding!

I would think that given the goose the U.S. housing sector has given the prospects for the U.S. economy, that the Chinese would be more than willing to widen the band at this point. That is unless they read the Pfennig, and are aware of the "shadow inventory" that's hanging over the housing recovery like the Sword of Damocles.

Speaking of China. Did you see that Australia announced that they are going to invest 5% of their foreign currency reserves in Chinese bonds. According to the Wall Street Journal (WSJ) Australia currently has an allocation of 45% to the U.S., 45% to Europe, 5% to Japan, and 5% to Canada. it was not announced who would see their allocation cut. And this makes sense to me, given the two countries' new foreign currency swap agreement for trading.

Last night, the Reserve Bank of New Zealand (RBNZ) left rates unchanged as I expected them to do. RBNZ Gov. Wheeler, took his usual shot at kiwi's strength, but the majority of his time was spent talking about how "growth in New Zealand has picked up." He went on to say that, "at this point, we expect to keep the OCR unchanged through the end of the year." The OCR is the Official Cash Rate. Their internal rate, like our Fed Funds Rate.

I find that his statement about keeping the OCR unchanged through the end of the year, to be a little premature. New Zealand is experiencing house price inflation in some regions, and this somewhat small bubble could get large in a hurry. But with inflation well below the RBNZ's 2% target, I guess he was feeling pretty cocky.

Across the Tasman, Australia printed their latest CPI (consumer inflation) and the weaker than expected print, threw more gas on the calls for a rate cut fire. CPI for the 1st QTR rose 2.5% (year on year), and was expected to rise 2.8%... So. the markets are getting all lathered up for a rate cut. But. as I've said many times in the past year, I believe that a Australia doesn't need a rate cut. I believe a rate cut to be counterproductive. The strong Aussie dollar (A$), which gets its strength mainly from its strong, positive rate differential, taken together with the higher interest rate are responsible for the drop in inflation year on year. Take the A$ strength away, by lowering the interest rate, and inflation comes back stronger and probably too fast to catch at the border!

But. The sad thing is that I doubt anyone that makes the tough decisions is reading the Pfennig. But that's OK, I guess. I'll be able to say, "see I told you so!" when this all unwinds in the next year. That is unless the Reserve Bank of Australia, is smarter than the average bear and doesn't' fall for this trick.

Yesterday, I talked to you about Norway's problem with the question of to cut rates or not to cut rates. The argument for cutting rates in Norway always comes back to the strength in the krone. The Norwegian exporters cry, and throw themselves on the floor and kick and scream that they are not getting their way, for to date, the Riksbank (Norway's Central Bank) Gov. Olsen, has yet to given in to these flaming Spock babies!

I saw a story on the Bloomberg this morning about a huge bond redemption that is coming up on May 15th in Norwegian Gov't Bonds. And immediately I thought of an outflow of krone from that maturity, for some holders won't want to keep an allocation in Norway. I mean, when they bought the current bond, it paid 6.5%! And with the estimate at about 60% of the issue being held by offshore investors, even a small portion of the 66.5 Billion kroner issue not remaining in krone, could push the currency down. So, watch for this. it could very well, give us some cheaper levels to buy.

Gold is back on the rally tracks today. The U.S. Mint is reporting sales of Gold coins are heading for the highest levels in almost three years since the price plunge two weeks ago. The Mint also announced that they had run out of 1/10th ounce Gold coins. I told you the other day the physical demand for Gold was soaring. Well, this is just a sample of that statement. And why not? Didn't you think that Gold had gotten too expensive to buy? Well, you're not alone. Apparently those that thought that are now coming out of hiding places and rushing in to buy at the cheaper levels.

I wonder what the price manipulators are thinking watching all this physical demand drive the price of Gold higher and higher. This can't be what they were looking to do, which was to scare the moms and pops and get them to sell their Gold. It worked for a couple of days, and then the physical buying began, and has only stopped for a breather during one trading session since. I love it! I wish I could see the price manipulators squirming in their seats, wiping the sweat off their foreheads, and trying to stop their nervous twitching.

OK. I've got two Then There Was This articles today. The first one came across my screen yesterday from WSJ, titled: Trustee Louis Freeh Sues Corzine Over MF Global Collapse. "MF Global Holdings Ltd. MFGLQ -3.23% needed cash, was being hounded by regulators and had been threatened with possible ratings downgrades.

None of those problems alone killed the brokerage firm in October 2011, according to a bankruptcy trustee's lawsuit filed late Monday. The trustee said it was the leadership of Jon S. Corzine and two of the former chief executive's top lieutenants that proved fatal. In the 61-page lawsuit, former Federal Bureau of Investigation Director Louis Freeh accused Mr. Corzine and his former chief operating officer and finance chief of "acts and omissions" over several months that were "grossly negligent" and a "breach of fiduciary duty" that led to the company's collapse"

And Then There Was This Too!... Again. thanks to my subscription to the WSJ! This is a story that I think will gain traction and one that I will follow closely, for I too want to know how the Fed intends to unwind their portfolio. Inquiring minds need to know!

"Two House Republicans have threatened to subpoena the Federal Reserve for nonpublic documents on how the central bank plans to wind down its more than $3 trillion bond portfolio without harming the nation's economy.

In a letter viewed by The Wall Street Journal, House Oversight Chairman Darrell Issa (R., Calif.) and Rep. Jim Jordan (R., Ohio) told Fed Chairman Ben Bernanke that they were frustrated at the lack of response to a February request demanding more details on the central bank's strategy to unwind assets purchased during years of its easy-money stimulus programs. The lawmakers say Mr. Bernanke continues to "willfully withhold" sensitive documents the committee has requested.

The American people have a right to know the true risks associated with the expansion of the Federal Reserve's balance sheet," the lawmakers wrote in a letter dated April 22. The Fed's obstruction and lack of transparency must stop."

Chuck again. I just shake my head in disgust over the MF Global debacle. and I would tell the two lawmakers looking to get answers from the Fed. Good Luck with that!

To recap. The fears that Chuck had about the Risk Off / On Days returning were put to bed, when U.S. stocks rallied yesterday. The currencies are back on the rally tracks this morning along with Gold. Aussie inflation was weaker than expected, but Chuck gives us his thoughts on why this shouldn't mean a rate cut is coming.

Currencies today 4/24/13. American Style: A$ $1.0275, kiwi .8455, C$ .9750, euro 1.3010, sterling 1.5265, Swiss $1.0570, . European Style: rand 9.1755, krone 5.8950, SEK 6.5975, forint 230.05, zloty 3.18, koruna 19.9055, RUB 31.48, yen 99.50, sing 1.2415, HKD 7.7645, INR 54.38, China 6.2384, pesos 12.24, BRL 2.0210, Dollar Index 82.94, Oil $89.88, 10-year 1.72%, Silver $23, and Gold. $1,422.22

That's it for today. Another good win last night by my beloved Cardinals in Washington D.C. And our Blues won, which put them in the playoffs. Now if they win their remaining 2 games, they can get a better seed. Andrew and Alex won their Water Polo game last night, with Alex scoring two goals (he should have had 3!) Then Alex had to go to an AP Review.. He takes all AP classes, which I'm very impressed with, for I wouldn't have lasted one day in those classes! Little Braden Charles was at the game with his lovely mom, Rachel, and he climbed all over the bleachers. I thought that would end up in tears, but it didn't, he had fun, and that was that! A day game today for the Cardinals, that's usually my nap time, so, I'll record it! I hope you have a Wonderful Wednesday!

Chuck Butler

President

EverBank World Markets

1-800-926-4922

1-314-647-3837

Reported by Proactive Investors 3 days ago.

HTC has announced a dual SIM HTC One in China, the handset will launch with the three major carriers in the country, China Telecom, China Mobile and China Unicom, the handset has some differences from the existing model. The

HTC has announced a dual SIM HTC One in China, the handset will launch with the three major carriers in the country, China Telecom, China Mobile and China Unicom, the handset has some differences from the existing model. The HONG KONG — In a striking sign of souring attitudes in Hong Kong toward mainland China, activists have called to reject plans to send $13 million in aid to earthquake-stricken Sichuan province due to concerns the money would be siphoned off by corrupt officials.

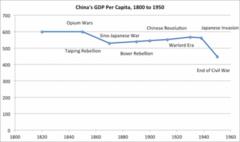

HONG KONG — In a striking sign of souring attitudes in Hong Kong toward mainland China, activists have called to reject plans to send $13 million in aid to earthquake-stricken Sichuan province due to concerns the money would be siphoned off by corrupt officials. China's rise to global prominence is one of the most compelling narratives of our time. In the last 30 years we have seen the greatest sustained reduction in poverty in human history. Hundreds of millions of Chinese have moved from an impoverished rural existence to a increasingly prosperous and ambitious urban middle class.

China's rise to global prominence is one of the most compelling narratives of our time. In the last 30 years we have seen the greatest sustained reduction in poverty in human history. Hundreds of millions of Chinese have moved from an impoverished rural existence to a increasingly prosperous and ambitious urban middle class. It is becoming increasingly evident that *Japan is attempting to use monetary policy to paper over the cracks of imploding foreign policy decisions*. The 'storm in a teacup' that has brought China and Japan into fierce rhetorical battles over the Senkaku (or Diaoyu) Islands is having far more deep-seated impacts on the people of the two nations - and implicitly their buying habits. Unfortunately for the embattled Japanese - they are the ones in need far more than vice versa. As Bloomberg reports, discrimination against Japanese is increasingly common in China, as the head of China's Honda plant notes, he’s "*never worked in a more hostile place*." The dispute over the islands is raising resentment with bars and restaurants showings signs at the door saying, 'Japanese are barred from entering.' "Wherever I go, like department stores or in taxis, people ask me whether I am Japanese," and the reaction can be frosty. Simply put, no matter how cheap the Japanese make their cars by explicitly devaluing their currency, the largest auto market in the world (that of the Chinese) will not be buying; summed up rather bleakly, *"I don’t really care about [car] brands,... but there are cars I won’t buy -- the Japanese ones. The reason is simple: Diaoyu."*

It is becoming increasingly evident that *Japan is attempting to use monetary policy to paper over the cracks of imploding foreign policy decisions*. The 'storm in a teacup' that has brought China and Japan into fierce rhetorical battles over the Senkaku (or Diaoyu) Islands is having far more deep-seated impacts on the people of the two nations - and implicitly their buying habits. Unfortunately for the embattled Japanese - they are the ones in need far more than vice versa. As Bloomberg reports, discrimination against Japanese is increasingly common in China, as the head of China's Honda plant notes, he’s "*never worked in a more hostile place*." The dispute over the islands is raising resentment with bars and restaurants showings signs at the door saying, 'Japanese are barred from entering.' "Wherever I go, like department stores or in taxis, people ask me whether I am Japanese," and the reaction can be frosty. Simply put, no matter how cheap the Japanese make their cars by explicitly devaluing their currency, the largest auto market in the world (that of the Chinese) will not be buying; summed up rather bleakly, *"I don’t really care about [car] brands,... but there are cars I won’t buy -- the Japanese ones. The reason is simple: Diaoyu."* This morning's key headlines from GenerationalDynamics.com

This morning's key headlines from GenerationalDynamics.com