One of the more interesting insights to emerge from the recent California summit between President Obama and Chinese President Xi Jinping is the Chinese leadership's expressed concerns over China's image and status as a rising power. As reporting on the meetings indicated, Mr. Xi spoke of the need for the United States and China to develop "a new model of major-country relationship," which would support China's rise and further the interests of both nations. More ominously (and frankly) he asserted, "China and the United States must find a new path, one that is different from the inevitable confrontation and conflict between the major countries of the past."

In these straightforward terms, President Xi's remarks reflect a clear understanding of one of the central tenets of international relations thinking: throughout history, rising powers have often been the primary source of conflict in world politics. Whether the burden for the initiation of wars or other calamities can be placed solely on the rising state may be of some historical disagreement, but more often than not, when systems of states have been confronted with a rising power in their midst, the historical record is grim. The interaction of rising and declining powers has been one of the key drivers of history, typically with high costs in blood and treasure and dramatic and far-reaching implications for the subsequent trajectory of international affairs.

From the Peloponnesian War, when a rising Athens challenged Spartan leadership over Greece, to the Thirty Years War where the failed Spanish and Austrian Hapsburg attempt to consolidate power ended with the Treaty of Westphalia and the introduction of the modern sovereign state system in Europe, these conflicts tend to involve all of the major actors in a system and have long-lasting consequences. Few escape unscathed. A rising France under Louis XIV, the "Sun King" fought a series of wars, eventually sparking most of the rest of Europe to ally against him. Napoleon's Imperial France effectively succeeded in conquering continental Europe, but his fixation on Great Britain, which had risen to power utilizing a very different model of empire, based on maritime commerce and trade and protected by naval power, proved his undoing. Britain's subsequent period of "Splendid Isolation" was premised on the avoidance of any one power uniting the continent and lasted until the end of the Nineteenth Century with Germany's emergence. Unsatisfied with the existing multipolar balance of power in Europe, Kaiser Wilhelm and later Adolph Hitler plunged the continent and much of rest of the world into two devastating wars that would ultimately end the "European Era," and allow for the rise of two new Superpowers: the United States and the Soviet Union.

Despite coming perilously close to a nuclear exchange during the Cuban Missile Crisis, the Cold War rivalry between the United States and the Soviets remained "cold" in large part because of role of nuclear weapons. The nature of the "absolute weapon" eventually dispelled most notions that it could ever be utilized militarily. Nonetheless, the Superpower competition encompassed the entire globe for over four decades, with Europe effectively divided into two camps, major military conflicts in places like Korea, Vietnam and Afghanistan, and a host of other interventions -- whether overt or covert -- into the affairs of smaller states by the two rival powers. With the collapse of the Soviet Union, the United States was left alone as the undisputed great power and the world has lived under "unipolarity" for over twenty years.

Now it seems the world may be undergoing another important shift. The Great Recession and expansive costs of fighting wars in Iraq and Afghanistan have conjured an image of the United States in decline. Alternative power centers, most notably China but also India, Brazil, South Africa and a resurgent Russia, have become increasingly influential in global affairs as Europe has struggled. It may be too soon to write off the United States, but it does seem like the world may becoming more "multipolar." Throughout history, such shifts have often led to conflict. Understanding this, China sees its emergence as both a tremendous opportunity but also a challenge. Managing the perceptions of its neighbors and the one power that could undermine its objectives -- the United States -- is a critical task.

President Xi was correct when he stated that "These are things that not just the people in our two countries are watching closely, but the whole world is also watching very closely...." The relationship between China and the United States is likely to define the nature of world politics throughout this century, and if the history of rising powers is any indicator of our likely future, there are troubled times ahead.

A Quick Note: Happy Fathers' Day to all of the dads out there! My Dad, Dave, Sr., sparked and fostered an interest in history and politics in me from an early age. I wouldn't be writing here without all of his support and encouragement. Thanks Dad! Reported by Huffington Post 2 hours ago.

In these straightforward terms, President Xi's remarks reflect a clear understanding of one of the central tenets of international relations thinking: throughout history, rising powers have often been the primary source of conflict in world politics. Whether the burden for the initiation of wars or other calamities can be placed solely on the rising state may be of some historical disagreement, but more often than not, when systems of states have been confronted with a rising power in their midst, the historical record is grim. The interaction of rising and declining powers has been one of the key drivers of history, typically with high costs in blood and treasure and dramatic and far-reaching implications for the subsequent trajectory of international affairs.

From the Peloponnesian War, when a rising Athens challenged Spartan leadership over Greece, to the Thirty Years War where the failed Spanish and Austrian Hapsburg attempt to consolidate power ended with the Treaty of Westphalia and the introduction of the modern sovereign state system in Europe, these conflicts tend to involve all of the major actors in a system and have long-lasting consequences. Few escape unscathed. A rising France under Louis XIV, the "Sun King" fought a series of wars, eventually sparking most of the rest of Europe to ally against him. Napoleon's Imperial France effectively succeeded in conquering continental Europe, but his fixation on Great Britain, which had risen to power utilizing a very different model of empire, based on maritime commerce and trade and protected by naval power, proved his undoing. Britain's subsequent period of "Splendid Isolation" was premised on the avoidance of any one power uniting the continent and lasted until the end of the Nineteenth Century with Germany's emergence. Unsatisfied with the existing multipolar balance of power in Europe, Kaiser Wilhelm and later Adolph Hitler plunged the continent and much of rest of the world into two devastating wars that would ultimately end the "European Era," and allow for the rise of two new Superpowers: the United States and the Soviet Union.

Despite coming perilously close to a nuclear exchange during the Cuban Missile Crisis, the Cold War rivalry between the United States and the Soviets remained "cold" in large part because of role of nuclear weapons. The nature of the "absolute weapon" eventually dispelled most notions that it could ever be utilized militarily. Nonetheless, the Superpower competition encompassed the entire globe for over four decades, with Europe effectively divided into two camps, major military conflicts in places like Korea, Vietnam and Afghanistan, and a host of other interventions -- whether overt or covert -- into the affairs of smaller states by the two rival powers. With the collapse of the Soviet Union, the United States was left alone as the undisputed great power and the world has lived under "unipolarity" for over twenty years.

Now it seems the world may be undergoing another important shift. The Great Recession and expansive costs of fighting wars in Iraq and Afghanistan have conjured an image of the United States in decline. Alternative power centers, most notably China but also India, Brazil, South Africa and a resurgent Russia, have become increasingly influential in global affairs as Europe has struggled. It may be too soon to write off the United States, but it does seem like the world may becoming more "multipolar." Throughout history, such shifts have often led to conflict. Understanding this, China sees its emergence as both a tremendous opportunity but also a challenge. Managing the perceptions of its neighbors and the one power that could undermine its objectives -- the United States -- is a critical task.

President Xi was correct when he stated that "These are things that not just the people in our two countries are watching closely, but the whole world is also watching very closely...." The relationship between China and the United States is likely to define the nature of world politics throughout this century, and if the history of rising powers is any indicator of our likely future, there are troubled times ahead.

A Quick Note: Happy Fathers' Day to all of the dads out there! My Dad, Dave, Sr., sparked and fostered an interest in history and politics in me from an early age. I wouldn't be writing here without all of his support and encouragement. Thanks Dad! Reported by Huffington Post 2 hours ago.

Filed under: Investing

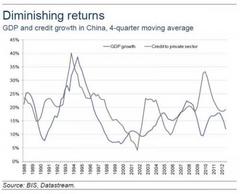

Filed under: Investing A week ago we showed a chart from Charles Gave which does a terrific job at explaining why the modern economic "science", in conjunction with the Fed's negative rate environment, have failed at their ultimate stated mission - to stimulate growth. The reason: the Keynesian multiplier, which has tracked the nominal US GDP 7yr average change with a very high correlation, is now negative. From Gave: "shows that the marginal efficiency of public debt, at least in the US (public spending in emerging markets from a low base usually improves productivity) has been declining structurally since 1981. And it seems that this marginal efficiency has now reached a negative level."

A week ago we showed a chart from Charles Gave which does a terrific job at explaining why the modern economic "science", in conjunction with the Fed's negative rate environment, have failed at their ultimate stated mission - to stimulate growth. The reason: the Keynesian multiplier, which has tracked the nominal US GDP 7yr average change with a very high correlation, is now negative. From Gave: "shows that the marginal efficiency of public debt, at least in the US (public spending in emerging markets from a low base usually improves productivity) has been declining structurally since 1981. And it seems that this marginal efficiency has now reached a negative level." Beijing (UPI) Jun 18, 2013

Beijing (UPI) Jun 18, 2013 While all eyes are on the Federal Reserve today as the market awaits clues into when the central bank will begin slowing its liquidity provisions, China's central bank continues its own snugging operation, keeping the money market rates at lofty levels.

While all eyes are on the Federal Reserve today as the market awaits clues into when the central bank will begin slowing its liquidity provisions, China's central bank continues its own snugging operation, keeping the money market rates at lofty levels. The Chinese bloggers featured in the new documentary High Tech, Low Life insist they are not breaking any laws. Their New Media reporting, however, casts a light on the country’s distrust of freedom that routinely draws the attention of state officials.

The Chinese bloggers featured in the new documentary High Tech, Low Life insist they are not breaking any laws. Their New Media reporting, however, casts a light on the country’s distrust of freedom that routinely draws the attention of state officials.