Filed under: Investing

Filed under: InvestingOver the weekend *Brookfield Asset Management* announced that it and its affiliate *Brookfield Infrastructure Partners* are selling the Longview Timber business to *Weyerhaeuser* for $2.65 billion. The deal consisted of 645,000 acres of high-quality timberlands in the Pacific Northwest. While these timber assets are located in the U.S., as you will see this deal is all about China.

Before we get to that, let's take a look at what Brookfield is selling. Longview Timber was originally picked up by the company in 2007 along with associated paper and packaging manufacturing assets. At the time, Longview was struggling as the economy began to turn and Brookfield was able to restructure the business by separating the timberland assets from the manufacturing business and then turnaround the operations of the manufacturing assets. Incidentally, Brookfield sold those paper and packaging assets in a separate deal over the weekend for $1.025 billion.

Brookfield has a history of acquiring complex assets, unlocking value and then generating exceptional returns for investors. In this case Brookfield is selling timber assets at a time when timber assets are hot. For perspective, Brookfield paid an estimated $3,150 per acre for the Longview Fibre timberlands in 2007 and was able to sell them for about $4,100 an acre which is at the high end of the market.

For a Brookfield Asset Management investors this deal is just another example of the company's ability to follow the advice of Warren Buffett to "be fearful when others are greedy and be greedy when others are fearful." That has enabled the company produce returns of more than 370% over the past decade while the S&P 500 has just returned 65%.

Part of its success has been in spinning off pure-play businesses like Brookfield Infrastructure which gives it a great partner for deal-making. Brookfield was able to park a portion of the timberland assets in Brookfield Infrastructure until the assets were ready to be harvested. So, while this deal marks the exit of timberland assets from the Brookfield Infrastructure portfolio, it enables the company to reinvest the deal proceeds into assets generating higher rates of return. Lately, this has included toll roads in South America, Australian rail and port infrastructure, as well as utility assets around the world. The timber business was never a perfect fit for its more regulated business mix, which is why it was of more value to the company to sell to a strategic buyer.

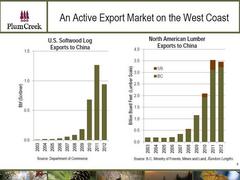

That strategic buyer, Weyerhaeuser, is picking up assets in a coastal location which provides easier access to Asian markets. That really is the key to this deal and why those acres are worth a lot more than timberlands located elsewhere in the U.S. As you can see in the following charts, China has rapidly increased its imports of North American lumber:

Source: Plum Creek Investor Presentation (link opens a PDF)

While Canada is the clear leader in terms of supply, it's facing a major threat from the mountain pine beetle. In the slide that follows you can see just how devastating this is to Canadian timberlands:

Source: Plum Creek Investor Presentation

What that spells is an opportunity for timberland owners in the Pacific Northwest. That's why the strategic location of these assets is important as its boosts Weyerhaeuser's position in the region by 33% to a total of 2.6 million acres. Not only that but these are highly complementary and contiguous with the company's existing acres.

For perspective, Weyerhaeuser owns almost as many total acres in the Pacific Northwest as *Rayonier* has in its entire portfolio, and well above the nearly 390,000 acres it has in the Pacific Northwest. Weyerhaeuser is also well above No. 2 timberland owner *Plum Creek* which holds just 471,000 acres in the Pacific Northwest. These newly acquired acres really puts Weyerhaeuser in a league of its own when it comes to having assets in the strategic Pacific Northwest.

So, just how important is China to the overall North American lumber supply market? According to estimates from Plum Creek, Chinese demand is about 5%-7% of the North American lumber market. That equates to about 200,000 housing starts, which is why owning timberland assets with access to export markets is so important to Rayonier, Weyerhaeuser, and Plum Creek.

While Weyerhaeuser is paying a pretty penny for that access, it should pay off over the long term as China imports more lumber even as Canadian supply remains constrained. That supply and demand dynamic is clearly in favor of Pacific Northwest timberland owners. Even better for investors is that while they wait for that long-term trend to play out they also get a nice short-term boost because the deal is immediately accretive to cash flow, enabling the company to boost the dividend to $0.22 per share. Overall, this is a very solid deal for Weyerhaeuser.

Timberlands are great long-term income generators which makes these companies great for income investors. If you're on the lookout for more high-yielding stocks, The Motley Fool has compiled a special free report outlining our nine top dependable dividend-paying stocks. It's called "Secure Your Future With 9 Rock-Solid Dividend Stocks." You can access your copy today at no cost! Just click here.

The article This Natural Resources Deal Has China Written All Over It Reported by DailyFinance 1 hour ago.