A week ago we showed a chart from Charles Gave which does a terrific job at explaining why the modern economic "science", in conjunction with the Fed's negative rate environment, have failed at their ultimate stated mission - to stimulate growth. The reason: the Keynesian multiplier, which has tracked the nominal US GDP 7yr average change with a very high correlation, is now negative. From Gave: "shows that the marginal efficiency of public debt, at least in the US (public spending in emerging markets from a low base usually improves productivity) has been declining structurally since 1981. And it seems that this marginal efficiency has now reached a negative level."

A week ago we showed a chart from Charles Gave which does a terrific job at explaining why the modern economic "science", in conjunction with the Fed's negative rate environment, have failed at their ultimate stated mission - to stimulate growth. The reason: the Keynesian multiplier, which has tracked the nominal US GDP 7yr average change with a very high correlation, is now negative. From Gave: "shows that the marginal efficiency of public debt, at least in the US (public spending in emerging markets from a low base usually improves productivity) has been declining structurally since 1981. And it seems that this marginal efficiency has now reached a negative level."The good news, at least over the past two decades, is that for all the failings of globalization, there were other developing countries and regions around the world, that had the credit capacity to inject debt momentum into their and, in an infinitely fungible world, the global economy. This is why China was so instrumental as a growth counterweight during the great financial crisis following the Lehman failure.

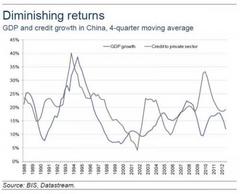

There is, however, a problem: as the chart below shows, China now has a Keynesian multiplier problem of its own. Even as the Chinese politburo and the PBOC have been injecting an ever increasing amount of credit into the private sector - the primary source of Chinese growth - the incremental GDP growth has been trending lower, and lower, and lower...

· The good news: unlike in the US, the multiplier is not yet negative, as there still is some GDP reaction in response to every "credit impulse."

· The bad news: each successive GDP response is weaker and weaker, even as the credit injection has no choice but to be larger and larger.

Which begs the question: is this why the PBOC has been so hesitant to ease once more, even as the inflation in the real estate market largely courtesy of foreign central bank liquidity injections by the Fed and BOJ which wash ashore on the mainland, well-aware such liquidity injections would have to be far greater than any before to achieve the same economic growth results?

And what happens to global inflation rates once China, which will ultimately have to ease to prevent the complete collapse of its banking sector, does proceed with proving that it is precisely the negative Keynesian multiplier that will be the great undoing of the Keynesian school of economics?

Luckily, once the BOJ's reflation experiment fails, and after China repeats the soaring inflation days of 2011 only to tighten all over again, there is still Europe. The only problem with Europe is that as we showed recently, credit creation is already record low and absent the ECB openly monetizing debt to inject reserves and boost stocks, there is little hope.

Finally, if Bernanke is indeed on the way out, which even more dovish ex-Goldmanite will replace Mario Draghi, as the onslaught for the final reflation attempt reaches its climax? Reported by Zero Hedge 44 minutes ago.